This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

Login with your ZeroHedge Premium account

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

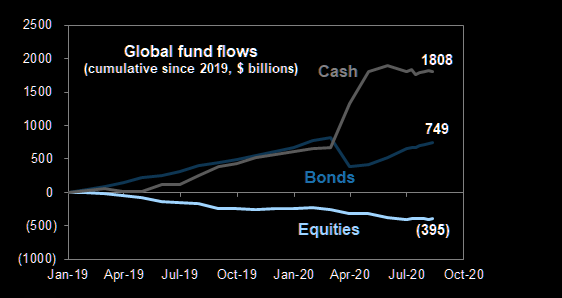

No uptick on global equity allocations.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

From Mom’s Basement To $6bn In 12 Months

Europe Rallies, Hedge Funds Sell Anyway

When Boardroom Animal Spirits Are Unleashed, They Don’t Stop Quietly

Mag7: One Last Look Before the Year Ends

Silver Goes Full Metal: 1979 Vibes

Gold: $31.5 Trillion, New Highs, And Still “Early”?

The AI Ouroboros: Big Tech Eats Its Own While Capital Loses All Meaning

A 10-Signal Cluster-F*ck

Santa Is Late, Not Dead — And Positioning Says There’s Ammo Left

The Vikings Just Killed Santa

Five Quiet Signals Suggest the Bull Case Isn’t Done Yet

Silver Is Flying, But Options Say Slow Down

The Great Vol Smash

Trust the Perfect Netscape Trajectory Or the Flashing Sell Signals?

Bond Vol Is Screaming ATHs for SPX

Positioning Isn’t a Problem - But Margin Debt Is

Rangebound Markets, Extreme Metals, and Late-Cycle Warning Signs

Gold: Under the Hood, Upside Panic Is Huge

Silver: Record Overbought, Volatility at Extremes

AI: Not a Bubble, But Not a Free Lunch Either

The World’s Hottest Stocks Have Gone Nowhere

From Sexy To Soggy: SOX Is Breaking At The Worst Possible Time

The Latest on Positioning

Japan’s 10Y Is Running the Show And Markets Should Be Nervous

Commodities Back at Support: Second Chance?

Crowded Shorts. Cash Gone. Big Bid About to Fade.

Interest Costs Are Exploding And Yields Are Still Rising

Everyone Owns Semis, Nobody Owns Software: Guess What Happens Next

The AI Trade Is Losing Its Footing as Asia Flashes Red

Everything Ex-Hot Is Getting Sold

Bitcoin’s at the Edge: Who’s Gonna Buy?

Gold Goes Vertical — Again?

The Japan Rate Shock Is Hitting AI

The AI Trade Wobbles: Asia’s Bellwethers Flash Yellow

The Long End Revolts — You Should Be Nervous

AI Was the Trade, Now It’s the Problem

This Is How Rate Accidents Start

Everything Is Bullish Except the Price

Gold Is Loading at ATHs While Volatility Sleeps, This Is How Squeezes Start

Double Top Déjà Vu or the Squeeze of the Year?

Russell Rips, Silver Explodes, AI Wobbles

Silver Shorts Carried Out on Stretchers

AI – Dream or Delusion? The Cracks Are Getting Hard to Ignore

Small Caps Go Beast Mode

Russell Roars, SPX Squeezes - and With No Bubble…

Cold Crypto Breeze - No Buyers, No Flows

This is The Cheapest Hedge in AI/Global Macro

VIX Sleeps, MOVE Moves - Who Do You Trust Into FOMC?

SPX Stuck, Rates Unstuck, Silver Panics

Gold’s Catch-Up Moment? Vol Cheap, Firepower Untapped

Silver on Fire: Vol Bid, Skew Explodes, CTAs Chase

If You Want Peace, Prepare for War: Europe Is Re-Arming

Rates on the MOVE - And the Market Isn’t Buying the Fed

Sell Low, Buy High - And Ignore the Code Red?

From Agony to Euphoria - But First Watch These Charts

3 Bond Charts We Are Watching

AI’s Forgotten King Roars Back

Europe Edges Higher as the ‘Less Bad’ Narrative Holds

Banks, Bankers & Breadth - Breakouts Everywhere — Choose Your Mania

A 3 Sigma Week: When Everyone Hit the Risk Button

Big China Flows Exit… Just as the Charts Start to Turn Up

Altman Goes Full YOLO While China Builds Top-Tier AI for Pennies

Markets Are Heating Up Everywhere - Except in the Trades People Worship (BTC, NVDA)

30Y Breaks Out, TLT Breaks Down - Strap In

Commodities Are on Fire - Breakouts Everywhere, Oil/Energy Up Next?

Gold’s ATH Setup Is Here: Explosive Seasonality Meets Surging JGB Yields

SPY Shorts, Crap Squeezes, and Asia’s Wild Tails

US 10-Year Keeps Trying, Yield Gaps Rip Wider, and Treasury’s Interest Costs Close In

China’s AI Awakening: A Coiled Market Ready to Rip

The Widowmaker Awakens: JGB Panic, Yen Surge, and a Global Deleveraging Trap

America’s New Housing Fix: A Mortgage You Can Die With

Today We Choose Violence: The Anti-Narrative Edition

The Wrap: Rotations Heat Up - and Volatility Sleeps… For Now

The Charts Keeping Us Awake at Night

Vol Panic Dead, Protection Puked - Now VIX Seasonality Sets the Trap

Japan’s Yield Surge Is No Local Story - Remember What Happened to the NDX Last Time?

The Wrap – Divergences Everywhere: Rates, Vol, AI, Crypto, Gold

Bitcoin Bros Are Back?

Gold $5k – Surging Flows and a Market Still Massively Underweight

Remember Rates in October? The Setup Is Back

The Wrap: SPX Stuck, BTC Cracks, Silver Screams, and Japan’s Bondquake Spreads

China Tech Wakes Up

Sexy Silver’s Squeeze 2.0

Bitcoin’s “Everything Hedge” Myth Dies: JGBs Blow Out, Trend Breaks, Death Cross Hits, and MSTR Turns Toxic

Bondquake in Tokyo - Yield Spreads Hit Absurd Extremes, Something Has to Break

10 Things Not to Be Thankful For This Monday Morning

"This may bode well for both upside and market breadth"

Europe Claims It’s “Recovering” — The Charts Say It’s More Like Crawling Out of a Hole

AI Wants Your Job — And Now It Wants Your Electricity Too

The 10 Charts We Are Watching This Saturday

The Wrap: AI Darlings Don’t Buy the Bounce - But Metals Sure Do

Gold Breaks Out. Silver Explodes. Volatility Erupts. Are You Still Flat?

Thanksgiving Coma: Fear and Panic Both Passed Out

If AI Is Really Booming, Why These Divergences?

Fear Implodes - What’s Next When Vol Dies and Bargains Emerge?

Soggy Asian AI - But Is This Re-Load Time?

The Wrap: Big Short Meets Big Buy and a BTC/VIX Plot Twist

It Was Useless as a VIX Hedge - Now Does BTC Rip as Vol Collapses?

Gold Breakout Brewing: Central Banks and Retail Are Loading Up

Healthcare Mania - Hedge Funds All-In, XLV Most Overbought Since 2018

Panic Out, Panic In - Heavy CTA/Short-Gamma Selling Followed by the Largest Two-Day Buy in Months

The Wrap: Keep It Simple - Just Follow the 10-Year

Gold's Consolidation Ending? Skew Suggests Squeeze

Google's GPU Killer - Phase 2

Fed Cuts > AI - The Only Thing That Matters

The Dog That Didn’t Bark: Asia’s AI Sentimentors Stay Dead Cold

The Wrap: Just Buy It – Bottom-Shorting Meets Shitty Liquidity

They Shorted the Lows Again – Max Pain Market

Google – From “Search Is Dead” to “TPU Beats GPU”

BTC Bleeds – Death Cross, Outflows, and Shitty Liquidity Collide

Corporate Animal Spirit Is Back

From Market Darling to Macro Dead-Weight: Germany’s 2025 Dream Unravels Fast

AI Megacaps Throw Off New Warning Lights — Or New Fuel — Depending on Your Religion

We have not seen Goldman this bullish China in a long time

Was That the Last Flush?

Market Flush, Gamma Chaos, NVDA Hammer, Santa Window - This Is the Setup

MAG Charts to Watch - Big Levels, Big Decisions

Systematics on Edge - Short Gamma Pain, but NVDA Still Runs the Market

Asian AI Darlings Crack - KOSPI Volatility Blows Out

Bitcoin: Store of Value? More Like You’re Shorting Volatility Without Knowing It

The Wrap: Semis Break, Skew Screams, and Cash Is Gone

Fear Explodes, Japan Melts Down And Massive Systematic Downside Convexity Looms

China’s AI Edge: Infinite Power, Infinite Upside, Superior ROI

Tokyo Bondquake - Bond Volatility Screams “This Isn’t Contained”

The AI Bubble Exposed

The Dollar Breakout - Bears Trapped as DXY Closes Above the 200-Day

The Wrap: The Big Long, The Big Short, The Big Fear

Bitcoin Bids Wanted

The Surge In Fear

Japan 30Y Breakout Moves Everything - AI, Crypto, Gold, Even NVDA

The Wrap: Volquake: Puts Explode, MOVE Screams, Tech Spreads Snap

Gold’s $4K Line Holds - Again

Fear Is Back - So Is Put Love

Asia’s AI Darling Just Blew a Fuse

The Wrap: Trend Lines Snap, Small Tech Smoked, CTAs Sweat

Bondquake in Japan - VIXquake in the US

Tech Hedges Bought, NVDA Nervous, Downside Convexity Lurking

Healthcare Wakes Up - Biggest Bid in 4 Years

Bitcoin’s Oversold, Hated, and Sitting on Support - Perfect.

Closing the Gap: Europe’s Quiet Return to Competitiveness

AI, GDP, and the Bull That Forgot to Breathe

Fart Coin Better Than Melania Coin

The Wrap: Nobody in Control

Friday Déjà Vu: Short Gamma’s Sell-Low/Buy-High Agony Returns

Gold’s “Fear Hedge” Dies - VIX Explodes, Gold Implodes

First Trend Breakdown Since May: 50-Day Snaps

AI’s Asia Meltdown - KOSPI Cracks, SK Hynix Gets Nuked… and the Spillover Risk Is Massive

The Wrap: The Puke - Small Cap Tech Crashes, Vol Pops, Crypto Cracks, Gamma Bites

Lower Highs, Exploding Bond Vol, Small Cap Tech Bleed… and CTA Downside Convexity Waiting Below

The LATAM Bull - The World’s Most Exciting Market Is Not Where You Think

Silver on Steroids - Upside Panic Is Back

Bond Volatility Soaring - Will It Spill Over to SPX?

Parabolic or not in AI

Keep Calm and Debt On - AI Borrows, Gold Gets Loud

Gold’s Furious Rebound

Europe’s Back - Breakouts Across the Board

Divergences We’re Watching

AI on Steroids - The Bubble That Refuses to Die

The Wrap: To AI, or Not to AI?

The Anti-AI Hedge: Apple Doesn’t Blink When NVDA Does

Bond Vol Explodes - Will SPX Notice?

European Banks Break Out: Powerful Squeeze, But Margins Whisper Caution

Revisiting Our Old Love With Obesity

Gridlock Stock And Two Smoking Barrels

The Wrap: Perfection Prevails - Shorts Maxed, Gold Wakes, Buybacks Blaze

Upside Pain: Shorts Built, Calls Burned, Dealers Flip

Gold Wakes Up: Big Sellers Flushed Out in the Puke

The AI Cartel: Miss Market, McKinsey & Goldman All In

When Everyone Believes the Same Story

Europe hums on a low-vol track

Teen Growth and the Double Club

Hammer Time: Friday’s Fear Flush May Have Marked the Low

Miss Market’s Mood, in 18 Charts

The Wrap: Suddenly Oversold, Shorted, and Systematically Sold

Say Hello to the 50-Day — NVDA’s $650 B Flush and Vol Wakes Up

Asia’s AI Bubble Just Blinked - Spillovers Coming Fast?

The Wrap: Bubble, Buffett, and Borrowing - Tech’s Triple Threat

Make-or-Break: NVDA’s $190 Decides the Market

How Artificial Intelligence Became the Market’s Real Religion

Dare the Rare? The U.S.–China Decoupling Trade Still Underpriced

Bitcoin’s 50-Week Test - Bounce or Breakdown?

If China’s Only a Nanosecond Behind - KWEB Calls Offer Massive Upside

The Wrap: Fearless Market, Fading NVDA

Cisco Was the Bubble. Nvidia Is the Market.

10-Year Breaks Out - MOVE Still Fearless

The Fearless Sell-Off: No Panic, Just Pain

EEM - Dollar Bid Wrecks the Tech Proxy Trade

The Wrap: Everything’s Stretched — Fear High, Valuations Higher, Downside Convexity Explosive

Gold on the Edge - $3900 or Bust

The Wrap: Somebody’s Gotta Pay for the AI Party

Mag7: The First Sell Signal in a Year

Boring BTC – The Magic’s Dead

When NVDA Looks "Poor" – The Real AI Mania Has Moved East

Let Them Eat LLMs

Are We Running Out of Equities?

Are We Running Out of Equities?

Positioning and the MAG7 Right-Tail Panic

Europe: The Trade Everyone Forgot, Still Winning

Goldman hedge fund honcho: "The current setup is admittedly demanding"

The Last Time Tech Looked This “Can’t-Lose,” It Did

The Wrap: Everyone’s Bullish the MAGs — What Could Go Wrong?

EEM – Weak Dollar? Think Again

TLT Trouble? — Calm Volatility Meets Inflation Fear

Dollar – The Cross That Matters

The Wrap: MAG Reversal - Too Much, Too Fast?

Super Tech, Super Stretched – Right Tail Gone Wild

The Gold Puke Pause

The MOVE Massacre

Berkshire’s Crossroads: The Oracle’s Old Economy Meets the Age of AI

The Holy Grail of Cancer — or Just Another Market Cult?

The Wrap: Fed Cut FOMO – Spot Up, Vol Up

Forced To Buy: AI Mania Goes Parabolic

$5 Trillion Beast – NVDA Eats the Industrials

The Wrap: FOMO Froth – Right Tail On Fire

Don’t Fight Retail: They’ve Poured In Nearly $300BN Since April

The Precious Puke – Levels To Watch

Small Business America Is Quietly Bleeding Out

Wall Street’s Great Emotionless Drift

After a Decade of Despair, Europe Rediscovers Its Pulse

The Wrap: Magic MAGs, Gamma Gaps & Fearful FOMO

Silver’s Puke - Chased Calls, Crushed Dreams

The Great Gold Crash

The Most Stretched Market on Earth

Post-Power Talks: Dragon’s Back, Techs on Fire

Fab Five Fundamentals

Too Pessimistic? Mag7’s Low Bar and Rising Right-Tail Risk

The Wrap: AI ATH - Climbing the Wall of Worry, Fueled by Fear

AI Euphoria Reloaded - Imagine We Go Full 1999

Gold: If This Is the Bounce — Imagine the Next Leg Down

The Other AI Superpower — China’s Innovation Bull Is Back

The Wrap: Market Still Stuck, Ready to Explode – Upside Pain Next?

Remember Oil? - The Shorts Sure Do

Gold – Healthy Reset or Just Overcrowded?

The Wrap: Range-Bound & Restless — Vols Bid, Momentum Cracks and Bubbly AI

Precious Levels To Watch

Déjà Vu: The 2006 Gold Surge Ended With a 30% Crash

Gold: If There Were Signs… Well, There They Were

The Wrap: Everything Is Weird — From Precious Puke to AI Fatigue

Silver’s Melt-Up Meets Gravity - The Party’s Over

Enough Is Enough - Gold’s Euphoria Turns Dangerous

The Wrap: They Puked the Low, Now It’s Melt-Up Mode

Upside Panic Reloaded: Gold Monthly RSI Hits 93!

Santa’s Coming - And “They” Just Shorted the Lows

Fab Five Fundamentals

Wall Street Acted Like It’s a 10% Sell-Off

A Golden Madoff? Sharpe of 4 - a level usually reserved for financial fiction

The Wrap: Can’t Keep Bulls Down

Gold Mania - Everyone’s In, What Could Go Wrong?

3 Charts On The Recent Volatility Explosion

SVB 2.0? SPX’s 50-Day Breaks as Vol Erupts

The Wrap: Welcome to Extreme Fear

Liberation Day Panic Vibes - VVIX Back at Chaos Levels

Mission Accomplished? Gold Just Did in Weeks What Took Months

3 Bond Vol Charts We Are Watching

From Guns to Gucci - The Defense Trade Unwinds

AI High Turns Into Hangover? Capex Cools And Clicks Fall

The Wrap: Parabolic Gold, Stuck Mag 7, and Stressed VVIX

Europe’s Longevity Time Bomb: The Pension Ponzi Nobody Wants to Talk About

Can’t Put a Good Man Down: Volatility Refuses to Die

The Magnificent Stuck

Gold More Overbought Than the 1980 Upside Panic

The Wrap: Fragile Calm - Stress Stays Fearful

Russell Ripping - Perfect Shakeout, Monster Rebound

3 Fear Charts We Are Watching

China Tech Cracks

Fragile Markets - Friday’s Shock Still Haunts the VIX

The Wrap: TACO Trade Tested, Metals on Fire

Fab Five Fundamentals: We are so back

SPX on Thin Ice - Must Hold Soon or 100-Day Comes Fast

Broken Markets: Silver Volatility Goes Vertical as Pure Panic Kicks In

Flows on Fire: $26B Rush Into Gold ETFs

Climbing The Wall Of Worry In Europe

My 13 year old daughter went all-in on BTC Thursday

Fear Reignited — Equities Break Key Supports, Credit Cracks, Vol Surges

The Wrap: Here We Go — Volatility Monster Awakens, Leverage Bites, Bulls Bleed

Credit Cracking - HYG Sends a Warning Shot

China’s Magic Fades — Fast Money, Falling Stars & Fugazi Breakouts

The Wrap

Precious Metals — Momentum Junkies About to Get Burned?

Vol Surge = Reversal Signal? Gold & Silver Options Flash Warning Signs

King Dollar Awakens: Big Squeeze Above 99?

Have No Fear, There’s No Bubble, Says Sell-Side

The Wrap: Nothing Is Impossible — AI Mania, Gold Roars, Palladium Breaks Out

Palladium's Power Break Out

NDX vs 1999 — Can the AI Frenzy Go Full Nuclear?

Can’t Keep Gold Down: RSI Screaming, 200-Day Left in the Dust

The Wrap: Bulls Keep Dancing, But Momentum’s Fading

Calls Gone Wild: Bullish Bets Near Record Highs

King Dollar Awakens? Gaps, Shorts & Seasonality Collide

The Wrap: Kamikaze Yields, Gold Roars, SOX Melts Up

Sexy SOX: Overbought, Overloved, Overheating?

Bondquake in Tokyo

Fab Five Fundamentals

A Meloni Market

Gold Loves Tokyo’s Bondquake

Overweight - not morbidly obese

Largest Nasdaq/S&P Gap Since Dot-Com -Enjoy the Quality Melt-Up

The AI Boom That Ate the Economy

The K-Shaped Economy: Why America’s Bottom Half Is Falling Behind

Bond Vol Implodes, SPX Cheers

The Wrap: FOMO Mania Meets AI Nuclear Fever

SPX 7300+, FOMO and Melt-Up Déjà Vu

The Wrap: Calls Chased, Puts Puked, and Squeeze Manias

Bitcoin 'Undervalued' by at Least $50-60k

Unstoppable China Tech: Got KWEB?

Down Candles, Hanging Man & Shooting Star - Is Gold In Trouble?

The Wrap: Put Hate, CAPE Stretches, Metals Melt Up

Sexy Silver Surges as AI Needs Shine

Magnificent Miners Go Parabolic

Granolas: From Market Darlings to Value Play

Double Tops Loom as VIX Fragility and CTA Convexity Build

The Wrap: NVDA Smashes Resistance, FOMO Builds, Convexity Risks Loom

Gold Exhaustion? Shooting Star Flashes As RSI Screams Overbought

China Tech Breakout: BABA Leads, Sideline Cash Chases

The Wrap: Gold Roars, MOVE Snores, Upside Gets Gamma Violent

Hate the Politicians - Date the Stocks

Too Calm? Bond Volatility Dead While Gov’t Shutdown Risk Builds

Now Is the Time to Buy the Dollar

Gold’s $4K Magnet: ETFs Roar, Officials Keep Buying

Banker's Ball

Fab Five Fundamentals

The 10 charts you need to know this Monday morning

Is it too early to start talking about a year-end melt-up?

The Wall Of Worry: Melt-Up Now, Capital Destruction Later?

Soggy BTC: Nearing The 200-Day - Should The Market Listen?

The Wrap: Breakouts, Bruised Bets and Bubbles

So Far, Just a Dip – Or the Start of Something Bigger?

Parabolic Silver: Froth Meets FOMO

Who Needs AI When You Can Have Defense?

The Wrap: Can’t Put a Good Market Down?

Dollar Trap: Specs Short, Squeeze Brewing

BABA Boom Meets China’s AI Fever

Tiny Tech Bubble Vibes: Nothing Impossible, Right?

Nobody’s Hedged For Real Gold Panic

Big Pain In Small Caps

Euphoria Kicks In: Momentum vs SPX Looks Like 2020 All Over Again

3 Silver Charts We Are Watching

Gold: Another Day, Another ATH...Specs Still Don’t Get It

We Have Heard That Stocks Can Also Trade Down

Big Trouble in Little China

Fab Five Fundamentals

Retail Army Goes Parabolic: 10 Straight Green Days and Counting

Lower every time this happened

The Wrap: Brutal Bull - Overbought Everywhere

$6,600 Gold? History Says Yes

Kill Bond Volatility: MOVE Crashes, SPX Feeds

China Bull… But Most Missed It

The Wrap: Upside Panic - Russell Rips, Most Shorted in Carnage Mode

Gold: Overbought, Overvalued, Overcrowded

Dead Brand Walking? Tesla Goes Parabolic As Fundamentals Collapse

The Wrap: Weird NASDAQ Candles, Russell at Resistance

Roaring Russell Hits Resistance

China Tech Explodes: FOMO Next

Achtung: DAX Cracks Below Range

EM Mania Now, Mean Reversion Later?

The Wrap: FOMO Rally Faces the Fed

Gold into FOMC: Unstoppable, Overbought

The Wrap: Tech Buy-In Meets AI Mania

Put Seller Party: What Could Possibly Go Wrong?

Fed Cuts, Fed Fear Fuel Gold Fire

The Seven Charts Goldman's Macro Trading Team Are Watching

Fab Five Fundamentals

The drugs start to feel like they are decaf

$4,000 Gold - Conviction Buyers and the “Forever Bid”

The Wrap: AI Euphoria Meets Put Hate

AI Bubble Hype? Credit Says No

Decade of Pain, But Will Small Caps Bite Back?

3 Bond Volatility Crash Charts That Matter

AI Can’t Run Without Silver

All This Bull, Sentiment Still Stuck

Blocked – Bitcoin’s Back Door Slammed Shut

Speculation Runs Hot, China Can’t Cool Down

Swipe Now, Moon Later: Has Sweden produced a new Spotify:esque stock darling?

The Wrap: Beyond AI - Downside Convexity, Buybacks Rolling Over

No AI, No Alpha

Asian Tech Breaking Out Everywhere

The Wrap: Divergences Flash Red, China Tech Breaks Out

Generals Don’t Lie: Last Time, SPX Sold Off

China Tech: Is This The Breakout Moment?

Mighty Russell: Years of Pain, Now Payback?

Lumberrrr Crash — 3 Charts We’re Watching

The Wrap: Inverse Fear – Cheap Puts on the Tape

Fab Five Fundamentals

Gold Goes Parabolic as Fed’s Credibility Burns

Is the Narrowness a Feature or a Bug?

Where Are We on That European Tactical Long Trade?

The Rich Hate Cash, Retail Army Loves Tech

The Wrap: NVDA Crashes, VIX Seasonality Hits - Can Markets Stay Immune?

Gold's Gamma Squeeze Is ON

You Can’t Put This Bull Down — China Roars Back

The Wrap: $1.5Bn Daily Buyback Bid Vanishes Just As Bond Vol Explodes

If only there were signs...

China’s Market “Exponentialism” Just Got Halted

The MOVE Index Just Screamed a Warning. Did You Hear It?

The Wrap: Overbought Gold, Oversold NVDA — Two Giants at Extremes

Contagion Live: JGB Explosion Fuels Volatility, Gold Surge

Contagion Live: JGB Explosion Fuels Volatility, Gold Surge

The Wrap: SPX Breaks Down, NVDA Cracks $170

Gold Breakout Goes Relentless

VVIX Screams Risk — Crowd Still Short VIX

China’s All-In FOMO

Rising Yields, Rising Fear: Bond Vigilantes Return

Comfortably worst

CTAs Maxed Out Again at 100th Percentile and Would Have to Sell >$70bn Over the Next Month in a Down-Tape

From First To Worst

Fab Five Fundamentals: Follow The Money

3,451 Cracker Barrels

The Wrap: BTC Cracks First — Tech To Follow?

China Flows on Fire – Shorts Burning

EU Luxury: From China Proxy to Catch-Up Play

The Wrap: NVDA Stalls, China AI Soars, Gold Loads

Gold – Specs Sold, CTAs Forced to Chase

Russell's Revenge

China’s AI Bubble Goes Full Mania

Missing expectations for the first time

Keep Dancing… Until Yields Break It

Shorts and Sceptics Fuel the Russell Squeeze

VIX Shorts at Extremes – Crash Risk Rising

The Wrap: Can’t Put Russell or Gold Down

Gold – Tic, Tic, Boom

Dollar Death Cross – And Then We Ripped

China Roars, Bitcoin Snores, JGBs Soar

Managements voting with their shareholder's money

China: Mother of Breakouts, King of AI

The Bullish Ph.D Says Time to Take a Breather

Where are the bulls?

The "things can only get less worse" long trade in Europe

Do Or Die For Healthcare

If you see a bubble, ride it...

Better than Tech

Please mind the gap between the AI hype and reality

Everyone Short Russell… What Could Go Wrong?

Shanghai Squeeze – Upside Panic On

Emerging Markets: Travel & Arrive

The Wrap: AI Bubble = VIX Time Bomb

The Risk Everyone’s Missing

Greed and Fear on Steroids

The Kanye–Chamath Top

The $4,000 Gold Dream: One Peace Deal Away from a Putin Punch

Too Much, Too Fast: Panic or Buy the Dip?

AI Won't Die Overnight

Gold Ready to Explode? Fear Says Yes, Cheap Volatility Is the Trade

Shanghai Roars, China Tech Snores — The Laggard Trade?

NVDA Cracks, AI Smacked, Tech Attacked

AI Mania, CAPEX Boom, and Mega-Cap Concentration — Too Big to Fail or Too Big to Fall?

Retail Chasing, Pros Fading, Crypto Wobbles, Edge to Hedge

Calm Before the Storm? Vol Bargains, VVIX Screams, Seasonality Looms

"We see immense value in owning hedges thru the rest of summer"

Russell earnings revisions breaking out for the first time in 3 years

Semis eating software

The bull is on ketamine

Fab Five Fundamentals

Market – Rich, Stretched, and Crowding Fast

ETH Fever: FOMO, Treasuries Buying, and $25K Price Targets

Tech at Dot-Com Extremes, Retail Roars, Skew Screams, and Cash is Gone

EM Mania – AI Eats Commodities, EM Prints It

UAL Soars as Premium Carriers Tighten Their Grip

Nasdaq Tops Dot-Com Era in Historic Valuation Surge

Russell Roars and Pain Trade Risk Builds

AI CAPEX Mania – Tech Titans Outspend the Rest of the Market 2-to-1

3 Silver Charts We Are Watching

2020 Vibes – Bare Positioning, Brutal Upside Risk

Russell Shorts Roasted, NASDAQ Boasted, VIX Ghosted

Europe’s Defense Bubble Runs Out of Bullets

Hedge Funds Slash Risk, Torch Russell, as Buybacks Go Brrr

ETH Mania Meets Corporate Hoarding — Stash Could Surge 10x

ChatGPT kicking those 30-year olds back into mom's basement

Mediterranean Melt-Up

The Flow To Know

Fab Five Fundamentals

So many doughnuts

Apple’s Back, Chat Is King, Fear Is Dead

Green Shoots of Froth

The "Lagom" Market

SPX Climbs the Wall of Meh – No Fear, No Greed, Just ‘Lagom’

Dollar Bounce Brewing?

Bounce? Done. Fear? Gone. Greed? Missing in Action

When healthcare was healthy

Vol Crushed, Puts Puked, Dealers Forced to Chase

Gold Specs Tap Out, But Gold Isn’t Done - Miners Know Something?

From AI to Importing Electricity — Time to Nibble Europe?

Yields Cornered, Vol Crushed, Equities Drift — But It’s the Pace That Moves Markets

Squeeze Chasers Stalling as Firepower Dries Up

Earnings on Fire: Breadth Surges, Tech Leads, and the US Stands Alone

SPX Holds the Line After Massive De-Gross

Taking a Bite: Buying Rotten Apple at Peak Pessimism

FOMO Meets Fear of Drawdown — Volatility Reawakens

911 dialing 911

Checking In on That Sweeney Top

The Two Tailwinds For The Bulls

The Boomer Cash Ain't Helping

August Anxiety Arrives

The crazy charts and huge numbers that make you go WTF

We Can't Shake That Sweeney Top

Death Cross & Short Squeeze - Dollar’s Revenge

The Sydney Sweeney 100% Top: As Good As It Gets

USD: From RIP to Ripping

AI Capex Mania (Spoiler: We’re Getting Dumber)

Is Goldilocks With Us in the Room Right Now?

Throwing up the GRANOLA

"Sick of this frustration and tapping out"

Deportation Nation: $170B War Chest Fuels Trump’s Record ICE Dragnet — Obama’s Numbers Now the Floor

Breadth is bad and that is good

Postcard from Warsaw

Europe Is at Risk of Sliding Into Economic Irrelevance

Who's going to buy your stocks here at ATHs?

China Stocks' Stockholm Syndrome

How low can the healthcare sector sink?

"Buy calls"

Even Melt-Ups Deserve a Devil’s Advocate

Bro Billionaires vs. Base

I'm A Singleton, I'm A Singleton

Miss Market Wants To Squeeze You

Postcard from Madrid

"Germany Is Back"

Your ex-girlfriend was right: Size matters

Throwing Up The TACO

Gone Streaking

The Monster That Is OpenAI and How Elon and Apple Could Counter

Don't shut up Dan Niles...

Brussel's Got Balls

"I’m not inclined to pick a big fight with either of those"

King of Bro's netting close to $10bn in BTC

When +35% Feels Weak: Froth Rises and the Market’s Begging for a Breather

Tariff Risk at Zero, Protection Cost at Lows—What Could Possibly Go Wrong?

Emerging Markets Regain Momentum

The Gold Grab Isn't Over—But the Smart Money Might Be Looking at Silver

Dollar Snapback: From Widely Hated to Painfully Ripping

Heresy in the House of Bull: Seven Unholy Esoteric Signs the Rally Might Pause

NVDA Eating Europe—Still No Real Euphoria

Tech Euphoria Meets Historic Fund FOMO

Massacre in FX: JPY Longs Panic, Dollar Shorts Scramble, Euro Melts

Golden Cross Deja Vu: 2020, 2023... 2025? The Melt-Up Playbook Reloaded

Calling All Contrarians

Everything’s Ripping—Until It Isn’t: Systematics Chase, JGBs Crack Bonds, BTC Wobbles, Dollar Awakens

Postcard From Munich

Parabolic Panic: Japanese 30Y Yield Is a Bigger Threat Than Markets Admit

BTC Rockets into Overbought Stratosphere—Classic Vacuum Move

Who Are You?

NVDA: Both very magnificent and very overbought

Summer Melt-Up Set-Up: $7 Trillion On The Sidelines Eye NVDA & BTC...

Breakouts Everywhere: BTC Booms, Metals Squeeze, NVDA Mania, Frothy Flows – and a Sell Signal

Gold Locked & Loaded: Eyes Breakout as Volatility Hits Lows

Moon Mode Melt-Up: BTC Breaks Out, $200K in Sight

Melt-Up Madness – Vol Collapses as Complacency Soars

If Something Cannot Go On Forever, It Will Stop

Make the Dollar Great Again – Shorts Could Get Steamrolled

Complacency Rising – Volatility Squeeze Ingredients in Place

This is a great set up for the melt-up trade

Easy Money, Forced Buyers, Melt-Up Mirage – Mind the Trap Doors

MOMO Meltdown – Is This Just the Start?

European Defense Euphoria – Breakout or Fakeout?

Market Has Ignored Worsening Macro

Fluid in Tokyo, Frothy in S&P, and Q3 Vol Lurking

Dollar Bears Beware – You’re Not Early

Tick…Tick…Tick — Japan Bond Market’s Fuse Is Lit

Extreme Dollar Hate, Extreme Stock Greed — And Zero Fear

Neutral-ish Exposure, Extreme Greed, and Extinct Shorts

Dollar Despised — But No New Lows in a Week

Drink Them, Date Them, Trade Them...

Stars & Stripes Is Back — The Death of US Exceptionalism Was Greatly Exaggerated

Extreme Greed Returns: Bulls Giddy, Shorts Gutted

Russell Rips: Shorts Torched as Laggard Goes Leader

Selling AI

The Most Stretched Positioning Levels In A Few Years

Dip Buyers Dominate as Market Sucks Shorts Out

Decision Time: BTC Coiled for a Breakout?

MOVE Won’t Die — Bond Volatility Creeps Back

Regional Banks Reawakening

Momentum Massacre: AI Crushed, Laggards Roar - DeepSeek Déjà Vu?

Dollar Death Cross or Dead Cat Bounce? Buyers Strike Deepens

Gold’s Range Games: Breakout Looms as Dollar Cracks