This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

Login with your ZeroHedge Premium account

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

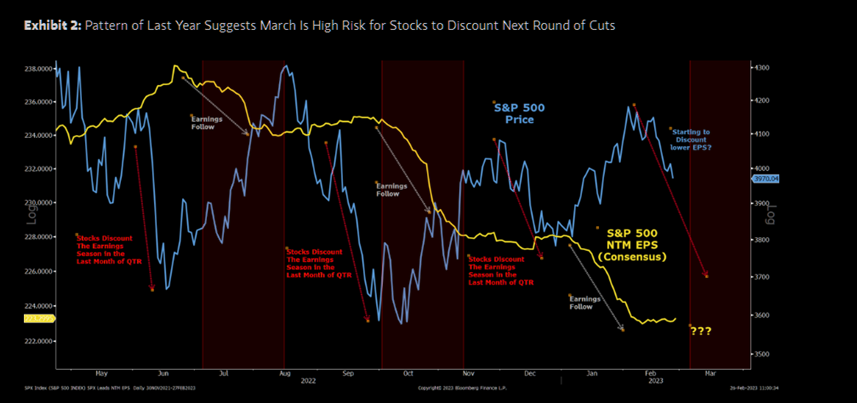

"Given our view that the earnings recession is far from over, we think March is a high risk month for the next leg lower in stocks...our top down earnings models suggest that NTM EPS estimates aren't likely to trough until September which would put the trough in stocks still in front of us...Investors who think stocks are attractive at current prices need to assume the NTM earnings cuts are done and will start to rise again in the next few months. This is the key debate in the market and our take is that while the economic data appears to have stabilized and even turned up again in certain areas, the negative operating leverage cycle is alive and well and will overwhelm any economic scenario (soft, hard or no landing) over the next 6 months."

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

Garrett continues: "if everyone is so bearish, who is buying?"

(un)natural answer = systematic community who have purchased ~100bn of global equities in the last 10 days.

Goldman's derivatives guru Garrett: "if you’re bearish, you’re consensus … doesn’t mean you are wrong, but you are in the majority". On AAII sentiment he writes: "...investors have *never* been this consistently bearish… for 11 straight weeks, >50% or respondents have been negative on the market"

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

This article is part of our Premium coverage, please click here to login and access it or sign up for a Premium account.

Crypto in Beast Mode: ETH Melts Faces, BTC Eyes ATH

Still Too Many Bears, Not Enough Pain Yet

Make the Dollar Great Again

Crypto’s Vertical Violence

Markets on the Edge of a Chase

Markets on Mute

Bitcoin – Volatility Looks Too Cheap to Ignore

“Europe Breaks Out: DAX vs. Russell Hits Multi-Year Highs — But Is It Real?”

No Panic, No Edge: Welcome to the Chop Zone

Gold: Like a Cork in Water

The Oracle of Everything on Everything

"The point is, ladies and gentlemen, greed is back"

The Squeeze vs. Underexposed Players

Death Cross Déjà Vu: Is the Rally Just a Trap?

Goldman: Upside massively under-priced

This can squeeze

Europe firing on all cylinders

Will extreme shorting flip to large covering?

Climbing the Wall of Hate

VIX: Here, But (Not Much) Lower

From Tech Pumps to Gold Dumps — It’s a Forced Re-Risk Party

Dollar Surge Wrecks Crowded Trades — MAGs Want Fuel

Gold Breaks Down as China Hits the Sell Button and CTAs Line Up to Follow

Due for a Pullback — or Just Getting Started?

Green Shoots for the Greenback?

No Trump Put for Oil

Volatility Reset, Gold Hype, Dollar Stress — Pick Your Poison

Dollar in the Doldrums — But It’s a Crowded Trade

VIX: From Panic to Pause – What's Next?

When Macro Turns Darker Than Markets

Aggressively Unchanged

Gold Hangover

Climbing the Wall of Worry — Nobody Believes the Bounce

Why So Serious?

Markets After the Bounce — Now Comes the Grind

Volatility in Retreat – Liberation’s Lull or Just a Pause?

Tech Turns, Shorts Burn: The Tactical Rally Is On

Not Dead, Just Dizzy: Equities Show Signs of Life

Massive Breakdown: Oil Refusing to Join Any Risk-On Party

Dead Cat or Comeback?

Sell Low, Buy High. The Pain Trade Isn’t Over

Tariffs, Trump & Treasuries: Why $4,000 Gold Isn’t Crazy

How Weak Is the Dollar - Really?

Green Shoots of Risk On?

Everyone Short Dollar - What Could Go Wrong?

Top-Line Beats Are the Lowest in Over 5 Years

Magnificent 7 as Absolute Loss Leaders

Is FED independence at risk?

3 Bond Stress Charts We are Watching

Gold Is Up Bad. Like, RSI-1980-Level Bad

Death Crosses, Pukes, and Parabolas

Gold to the Moon?

Dollar: Death Crossed and Deeply Oversold

There Is a Burning AI Hole in Big Tech's Pocket

It Takes Bulls to Have a Bull Market

Sideways, Stressed, and Searching for Direction

Putting Gold’s Recent Rally (+25 Percent YTD) into Historical Context

Markets on Mute: No Risk Budget, No Love, No Direction

Gold’s Up 25% — Good Luck Explaining Why You Missed It

Death Cross Drama Meets the Most Bearish Equity Stance in Years

Vol’s Down, Nerves Aren’t: A Fragile Healing Begins

How to Believe in Continued European Equity Outperformance

Welcome to the New Deglobalized Reality. The Bear Is on the Boat

Positioning’s Wrecked, Vol’s Fading - Is the Market Quietly Bottoming?

Dollar - Down, But Not Out

Bonds Toasted. Dollar Out? Sure - to what, exactly?

When economists are this bearish...

Bend the knee for Trump

Gold Euphoria, Bond Mayhem, Dollar Disgrace

Dollar Drama – Safe Haven Status Cracking?

Bonds Breaking, Gold Flexing, VXTLT on Fire - But Yeah, Totally Safe

Gold - The Everything Hedge Is Everything Again

Very Stable Genius

Upside Panic: Shorts Torched in the Mother of All Squeezes

Not Your Grandpa’s Treasury Market

"Trump Playing With Liquid Nitro"

Death Cross Countdown: No Real Bid Until 4600

Post-Crash Syndrome: Markets Are Stressed, Fragile, and Need Time to Heal

"Earnings are so strong" - But are they though?

VIX-tory Lap: Fear Is the New Asset Class

This Bear vs. a "Normal" One

The Party Is Over

Gold After the Pullback: What’s Next?

Oversold Madness - Smart Money Says "Buy the Dip"

Beyond Panic: Fortune Favors The Brave

Why Trump Tariffs Are Smart

Warren's Winning

The View From the Volatility Market

European Carnage

TME Weekend: Are We There Yet?

Why It Should Not Bounce Here Yet

Why It Should Bounce

S&P500 5000 or 3100? Call it!

Is It 1930 All Over Again?

Market Takes No Prisoners

Markets in Full-Blown Panic - VIX Goes Vertical

AMZN -10% vs Costco flat / WMT -3%

An Orderly Normal -5%

Trouble, Tariffs and Broken Trendlines

Worse than the worst case scenario

Wake Up Warren! Big Tech "Cheapest" in 10 Years

Why China Has Already Won

Here we go again: Europe at risk of recession

The CTA Situation: It's Complicated

Fundamentals Don’t Lie: Negative Revisions Hit Decade Highs

Déjà Vu with a Side of Pain: 2022 Called, It Wants Its Headache Back

DOGE Goes From Meme to Machine: Cuts Now Very Real

Reign of Trump Tariff Terror Leads to Total Non-Confidence

Does This Look Bullish to You?

SPX Rejected at 200DMA - Is This the Beginning of the End?

Nothing Good Happens Below the 200 day Moving Average

Markets on Mute, Gold Screams Higher

DOGE Will Ultimately Fail

That Was Quick! Long Europe Is Now Contrarian Again

Goldman Sees Gold Tail Scenario Hitting $4,500

Tech Tumbles and Death Crosses

Chasing Gold Here? Think Again - Options Might Be the Smarter Bet

Valuations, Flows, and Seasonality All Say One Thing: Buy US, Fade Europe

Housing Hopes! Goldman Sees Incremental Confidence From Prospective Buyers

Here come the AI agents

Shorts Get Squeezed, FOMO Gets Loud

"We start to rally again on March 23rd"

Concordia Europa Invicta

And the Winner Is....China!

A Trillion Dollars of Selling

Buy the Dip, Buy the Rip?

Will Oil Follow the XLE and Bounce?

MOVE Meltdown, VVIX Implodes - Pensions Ready to Buy Big

Your Daily Dose of EUphoria

The Big Bond Fear Fade

The Fed Put: Certainly Uncertain

Imagine the Pain If This Rally Has Legs…

From Mag to Drag: Bargain or Bust?

Bullish Europe - Could Get Über Bullish

Is It Safe to Get Back In?

The 650 Elephant Gold's Rampage - Time for the Overshoot?

The Squeeze: Selling Low, Buying High - Again

Europe: Is There Room for More Convergence?

The Bear Case: Consumers Reduce Their Spending, Causing a Recession

Can We Rally Without Having Had Proper Capitulation?

History and Seasonality Scream BTD

Cracks in Credit

Muted Volatility, Cheap Tech and Shiny Gold

Fear Fatigue: The Slow-Motion Market Meltdown

Gold - Consolidate, Break Out, Repeat - Next Surge Imminent?

Equally Fine Arguments on Both Sides

This Has Not Happened Since Biden Was Sharp

Huge Tech Convexity and Hedge Fund Bloodbath

Euro Euphoria - Overbought, Overhyped, Overdue for a Pullback

The Bad Earnings News Will Dominate

Leverage Reset Almost Done

Elon Derangement Syndrome (EDS) Has Gone Too Far

You Can Go Your Own Way

If It Bounces, It Could Bounce a lot

The Pulse on Panic

Bear Takes No Prisoners

Is Trump Watching This...?

Cracks in the European Bull Story?

60% of the Nasdaq is Actually Doing Okay

-30% Is the New Normal

Would You Fight for Your Country?

NDX - Too Much Too Fast

DAX MEMEs, Eurostoxx Dreams

Sell First, Think Later – The New Normal

Grinding Panic

Too Late to the Euro Party

It Should Really Bounce Here

China Tech Goes Turbo

War! Who Is Winning Between Europe and the US?

Europe: Once-in-a-generation shift

Stocks Dumped, Who’s Left to Sell?

Systematic Wipeout: Forced Selling, Leverage Unraveling

Bond Volatility Screaming Loud and Clear

Oversold, Overstressed - Trump Put Time

Time for MAGA over MEGA

Bitcoin - Leverage on Steroids Cuts Both Ways

Reality Check Hits, Stress Explodes

Dare the Bear: Bounce or Breakdown?

Europe - Guns, Growth, and Gains

Bond Volatility Explodes, Few Notice

Long-term parking

The Trump Recession

Now or Never -Bounce or Break

Bitcoin Bloodbath: 200-Day Support Shattered

Tech Carnage - Make or Break

Fear Running High

Gold's Breather: Just a Much Needed Pause

Life After the NVDA Print

Bitcoin Pukes, Leverage Cracks and Chinese Teflon Tech

Is NVDA's Upside Risk Underpriced?

The True Teflon Tech

Fear Strikes Back - Dare to Buy the Puke?

Crypto Crashing

Hit in the head by a DOGE ball

How Much More for This Historic China Rally?

The Macro Tourist's Case for Japan

Green Shoots of Fear

3 "Lagnificent" Charts To Watch

Latest Observations from Volatility Markets

One of the Most Successful Investors in the World Expects a Significant Correction

European Meme 2.0: Too far too fast

It's Disturbing

Markets Rolling Over

Red Flags in Tech

This Tech Mania Shows No Mercy

US Range Mania, China Tech Overheated, DAX Stressed

Goldman's 7 Reasons Why Stocks Will Trade Down

Solid SPX & Gold, DAX in Distress

Meme DAX - The Brutal Reality Check

Protecting Purchasing Power for Hundreds of Years

Risk On, Cash Out - Gold, China, DAX Speculation Surge

Catch me if you can

DAX - MEME 2.0 Mania

3 Gold Charts We Are Watching

War & Peace

Europe's 25-year long desert walk coming to an end

Goldman upgrades China on AI

A META analysis of the 20-day streak

Bear Mania, Europe’s FOMO Frenzy, and Gold’s Collapse

China Tech Explodes - The AI Revenge Rally

DAX’s Upside Panic vs. SPX’s Sideways Snooze

Gold - Consolidation vs $3500 Scenario

DAX - Sucking Suckers In

Mr Putin, tear down this war

Rates Rising, Inflation Inflating, King KWEB Reigns

Equities: Strong Demand, But Fading Soon

Germany Going Meme

MAG Meh, MEGA DAX and Gold's Shooting Star

Gold - Enough is Enough

CITI Says This European Rally Still Has Legs

Tech Wars and Metal Mania

Gold Bros Winning: $3k Surge Incoming

The Deepseek Winner

European Reconquista

End of an era - we are getting worried about Mag7

The Pro / Bro Tango

One Point One Trillion Dollars

Choppy Waters: SPX Stuck, MAG Wobbles, and Gold Still Glows

China Tech on Fire: Still Ignored

Bulls Retreat, Bears Roar as Stealth Bid Returns

Shorts Smoked, Retail Roars, DAX Defies

Schhh - This Tech is Up 20% Since Mid January

"I can’t help but wonder… are you harboring any magnificent, high-potential German stocks in the basement of your portfolio?"

Gold Breakout, Rates Breakdown and Sleepy MAGs

Retail Mania: Actually Bigger Than at the Height of the 00 Bubble

3 Gold Charts We Are Watching

3 Rate Charts We Are Watching

Those Lazy Europeans

Stuck in Range, But Tech Inflows and Buybacks Roar

Gold - Panic Buying

You Can't Spell China or Stealing Without A and I

Gold Glows, Retail Roars, Pros Sweat

Bitcoin Blues

Fear is Here. Panic Not (Yet)

Dominant Dollar - Waiting for Parity

The 2nd Longest Tech Uptrend in History

Retail Army Has Been the Main Buyer at ATHs

Is There a Secular Bull Brewing in Europe?

Is Miss Market trying to tell us something in NVDA?

Vulnerable Shorts

NVDA - The Laggard Play

Golden Vacuum, Deepseek Domination, Bears AWOL

Gold - Vacuum Above $2790

What's Next in NVDA?

China tech call volumes exploding to the upside

AI Abandoned

Lights Out? AI Power Plays Face a Reality Check

SOX - Bounce or Bear Trap?

Apple - Deepseek Winner

More "croissant and cafe au lait" - juice in the MEGA trade

Marry me, Meloni

The Bulls Mount Their Defense

NVDA: Hot Money Turns Dead Money

Deepselling Triggers Panic

"Starting to feel a bit uneasy about consensus forecasts"

DeepSeek: Are Markets in Deep Shit or is This Just a Blip-Dip?

The Strong Signal Is That There Is No Signal

Venom-Fang into the heart of the AI bull

Gold’s Rally, Silver’s Lag, Euro’s Bounce, and VVIX’s Warning

3 Silver Charts We Are Watching

Gold's Overbought Frenzy - Smart Traders Are Turning to Options

China's nightmare

SPX Stuck, Shorts Disappear, Retail Surges - And Sentiment Flips Up

Getting Late To Chase The Market

“Downside Protection Is For Suckers”

Jack Welch would be proud

Guess who's back!

Shorts Get Crushed as FOMU Takes Over

The MEGA Chase

Upside Pressure Builds - But Don't Forget Protection

Take another bite of the GRANOLA

Melt-Up Momentum

3 Gold Bull Charts We Are Watching

King Dollar: Huge Moves, Huge Levels, Huge Long and Hugely Stretched

Reasons To Worry in Magnificent Seven

The Break Out? Futures Squeezing

Make Bitcoin Great Again

Are you ready for the Brazilian butt lift-off?

MEGA: Make Europe Great Again

Did Buy The Dip Really Become Buy The Rip ?

Teflon Tech, Dollar Risks and Bitcoin Bull

Too Many Bears - Time for FOMO?

Big Shorts, Heavy Giants, and The Dormant Bid

3 Gold Charts We Are Watching

3 Rate Charts We Are Watching

Tesla to fundamentals: Go F yourself

The Dollar - Too Much, Too Fast?

If Goldilocks is back, is it time to buy EM?

Max Pain Market

Market Dislocations Too Big to Ignore

This "molly dealer from Chechnya" is killing it

Big Dollar, Big Inflation, and Cautious Big Money

Nervous Bond Traders, Sky-High Volatility, and the Ripple Effect on Equities

XLE as a hedge: Cheap & Underowned

66.6 times. Thanks for playing

Deal King Sees Barbarians Getting Closer

To Bounce Or Not To Bounce

"We need to beat"

Fragile Markets: Breaking Trends, Rising Panic and Oversold Conditions

Something Odd Is Happening in Bond Markets – Should We Worry?

China: No way to fix this

Will the death of disinflation cause an actual 10% correction?

2025 to be another challenging year for Europe

The Optimal Bitcoin Allocation

"Getting close to a BTD opportunity"

Rising Rates And Rising Fear

Gold - The "Everything" Hedge Waking Up

18 years ago, the domination started...

Key Levels, Recession Dilemma and "Snap" Risk

Europe: Things can only get better

3 Margaritas: Do we need the extra juice?

Markets: Trapped, Stressed, and Poised for the Next Move

Bond Volatility Soars - Will Equities Feel The Heat?

Nasty NVDA, Evaporating Shorts and the Big Long

Rising Rates Matter

3 Gold Charts We Are Watching

VIX: The Calm Before the Seasonal Surge

Stocks - Bouncing Big, Betting on AI, and Bracing for Bonds

Time For the AI Laggard

Mind the Gap: Growth Strains, Tight Conditions, Q1 Risks

3 Dollar Charts We Are Watching

Fast and Furious: Hedge Funds Dump Size, Tech's Bounce Fuels Frustration

Too Much Fear, Too Many Bears

Gold - Time to Move

3 Rate Charts We are Watching

Magnificent Dollar and Oil, While Stocks Not So

3 Tesla Charts We are Watching

Make-or-Break Levels for Markets

China's Market Meltdown

Goldman: Why are we not penciling in even more deportations?

Hey ChatGPT, will AI stocks rock again in 2025?

Value Investing did not die with Charlie

Who farted? The Trump bump at risk of becoming a dump?

From Betrayal to Opportunity: Why Silver Shines as a Smart Investment Today

Tech vs the rest

USA USA USA

Max Pain Market

Equities At "Make or Break" Levels as Stress Surges

RFK & the Death of Pharma

The Crypto Puke

Hungover Markets

Fragile Markets Haunted by VIX, Leverage, and Liquidity

Life After the Crash: Index Charts To Watch

3 Massive Golden Crosses

2nd largest VIX spike ever

Pure Powell Panic

Crypto Bulls: Hype vs Reality

Left-Tail Jitters, Poor Breadth and Small-Cap Struggles

Gold's Glow Fades: Make or Break at $2610

RFK & the Death of Pharma

AI is so 2024

Green Shoots of Upside Panic

Bitcoin: Store of Value or MEME Mania?

Crazy making a comeback

RIP December 16th 2024: The Death of Disinflation

Buying VIX here is simply too attractive to ignore

Surging Rates, Rich Tails and Naughty NVDA

Gold And Silver Charts We Are Watching

Dollar - The Upside Vacuum Risk

Crowding Risks, Rate Moves, and the Final Push Ahead

3 VIX Charts We are Watching

Rate Reckoning: The 10-Year’s Golden Cross

MAG on Fire: Overbought and Unstoppable?

Reviving Russell: The Bull Case Looks Compelling

"A late 1990s-style leadership melt-up"

What Bears Should Fear

SOX Struggles, NVDA Fades and Gold Glimmers

Europe - Life Post the Massive Squeeze

Monday Momentum Mayhem

No support: Lowest dividend yield in over 20 years

Bullish Illusion

Time for Gold (again)

3 Charts on Crashing Bond Volatility

Sentiment Approaching the Glory Days of Stimulus Fueled Frenzy

A second chance in China

Europe Is Not Down and Out

The last train left about an hour ago

Dollar to re-test the 2022 high

The Bro's and the Bling Bling

Vol’s Dead, Puts Hated, Bulls Inflated

Bitcoin's Wild Swings, ETF Mania, and MSTR’s High-Stakes Game

Looking at the world through a negative lens

Date, don't marry Brazilians

Europe is in deep shit - but everyone has already traded it

Be Long...and Buy Cheap Puts?

In Search Of Irrational Exuberance

A legend expects a crash in NVDA relatively soon

Will the real economy please reveal itself...?

Big boom potential: Best in 100 years

Bitcoin Chilling - Life Post the Squeeze

Why so serious?

Breakouts, Bullish Bets, and Upside Vacuum Risks

The $140 steak

Upside Force

Too hated? Euro Hate at Multi Year Highs

The $140 steak

Dollar Dives, SOX Slips and Russell Takes the Crown

Europe Is in Deep Shit (VI)

Dollar Breakout Fizzles

Call Mania, Rising FOMO and Trapped Dealers

3 Euphoria Charts We Are Watching

The biggest buyer is grinding away

Mag7 Clouds? Top of the Trend-Channel and Significant Narrowing

All These Chart Analogies Scream Melt-Up

Small Caps Soar, Gold Crumbles, Dollar Wobbles

The 5 Things That Matter

Big Things in Small Caps

Gold and Dollar: Ripe for a Pause

3 Rate Volatility Charts We Are Watching

Toto, We Are Not in Kansas Anymore

Perfectly Normal Pause Ahead of the Year-End Melt-Up

We love it! A short-seller as head of Treasury

Unstoppable Inflows

Gold Fever

Gold Glimmers, Dollar Flexes and Bitcoin Extremes

Europe is in deep shit (part 666): Enter Hitler

Bitcoin: The Golden Cross, The Trump Bump and The Overshoot

Soggy SOX, Super Saylor and Small Stress

Green Shoots of Fear

King Dollar

Most Overbought Since 2007 – And That Bodes Well for the Year-End Melt-Up

To Hold or Not to Hold

Gold Post the Trump Puke

Hawk:ish tua

Warren's worried. Should you be too?

How Extreme? Kicking the Tires on Mag7

The Largest Monthly Outflow for Utilities in More Than a Decade

The Big Long

Rates Ready to Reverse?

3 Gold Charts We Are Watching

RFK Jr drives pharma to 15-year low

"Too high" - and then the Trump bump ran out of steam

We are detecting a pulse

SPX Stalls, Tech Crumbles, SOX Sinks and Bulls Bet Big

Bitcoin and the "Ultimate" $200k Destination

SPX Stalls, Russell Wobbles Despite Inflow Mania

Massive Dollar Reversal in the Making?

Gold's Crash: Oversold and Outdated

Red Sweep Reversals...?

The Return of M&A

SOX Wobbles, Gold Cracks

Random Melt-Up Bitcoin Charts

3 Tesla Charts we are Watching

Does (other) Crashing Tech Matter?

Gold's $2600 Moment, Euro(pe) Meltdown and SPY’s Inflow Frenzy

"Add crypto exposure asap, Call us if you need help"

Unstoppable Trump Bull Train

Gold’s Freefall: $2600 "Make or Break"

Bitcoin - Most Overbought Since March

Europe is in deep shit (part III)

Hello SPX 10.000

Hedge fund hallelujah!

Dollars are my favorite color

Beyond Bullish

180x revenues: AI gears up

The Magnificent 7 in a MAGA world

Magnificent Break Out

Bond Bounce: Is the Yield Spike Overdone?

Chinese Bazooka > Tariffs

Trump Triggers Tesla

Trump Turbocharges Markets

The Great Gold Puke

MAGA Money Moves

De-Risked Into the Event

Chinese Speculation Fever: Big Comeback Begins

Election Countdown as SPX Battles the 50-Day

All-In: Hedge Funds Push Limits

Weak Hands Out, Strong Hands In: China's Equity Shift

The Quants are "All-In" going into the election

Europe is in Deep Shit: Part II

Hedge funds reloading Mag7

Warning signs

Meet me at Obesity Week

Rates Rampage

Elevated Fear Into Elections

"Last Night in Sweden": Trump's 2017 comments were spot-on

Flashing Fear

The View From The Volatility Markets

3 Bull Trap Charts We Are Watching

Seasonality says melt-up

Overshooting Yields, De-risked Giants, and Gold’s Relentless Rise

China’s Market Detox: Speculation Soars Amid Pullback

Time for Tech FOMO

Surging Rates: Can Stocks Take It?

Bitcoin to $125.000

Crashy Oil, Smooth Gold and Immune Equities

3 Gold Charts We are Watching

Late to the Rates and Dollar Party

Oil Craters: Geopolitical Jitters Ease

Which inning on the "Bump from Trump" trade...?

Europe is in deep shit

Magnificent 7: Can the worst performer now again start to shine?

Tactical cycle bottoming: Will 2025 be a record year?

Stuck in the middle with you

What would a Red Sweep mean?

Gold Glows, VIX Blows

Missing the Bull - Forced Buying May Be Next

Second Wave: Is China’s Market Set to Surge Again?

Big buying. Could get much bigger

Quantum computing: Wall Street's next big bet

Two poor candidates - but stocks don't care

Borderline Euphoria

King Dollar: Overbought, but Still in Control

Surging Rates: The Pressure is Real

Yardeni to Goldman: You are just wrong

Beware Rising Wedges and Surging Rates

Goldman Downgrades the Star of Stars

Lowest Stress Ahead of an Election Ever

Precious Metals' Monster Momentum

Action Everywhere But Stocks

Rising Rates Spark Bond Volatility, Putting Equities at Risk

Sexy Silver and Mature Gold

Only 1% annual real return over the next 10 years…?

An update from probably the most important trading desk in the world

Cyclicals breaking out but they are still underowned

Huang's Law & other insane numbers

Forget about the Roaring 20's

Goldman downgrades Europe to way below consensus

Serious FOMO, But Not For US Stocks

Silver's Explosive Breakout

"Their wives and their wives' lovers are all voting for me"

Rising Wedges, Fading Momentum and Solid Gold

3 Big Small Cap Charts

3 Charts We are Watching - Nibble China Again?

This Is England: De-ration nation

Surging Dollar, Surging MOVE and Sinking Europe

Flow Guru and Quant Wizard on the Right Tail

Could This Stress Derail the Equities Bull?

Gold: The Untouchable Asset Defying Gravity

Trapped by Tech

Oil: Chaos, Stress and Shorts

Biggest Inflation Swap Surge Since March Raises New Concerns

Put Hate, Extreme Greed and Some July Déjà Vu

"Made in China" Bull - Stressed Yuan and Cheap Collars

From 666 to 6666

"Not just insane, crazy too"

Those machines are being turned back on

Don't think we've ever seen this negative sentiment at ATHs

Wall Street turning on Musk

6666 Fever, China Mania and Cheap Upside

The Pulse on AI (and NVDA)

King Dollar

Extinct Bears

SPX Snoozefest While Volatility Pressure Mounts!

What's Next For Magnificent 7?

Stock's Silent Surge

Santa Sees Strong Seasonality

Oil and the Volatility Panic

3 Extreme China Charts

Steady SPX, Smoked Sucker and Solid Stress

Gold Under Pressure - Too Many Goldilongs?

Surging MOVE Poses New Threat to SPX

The China Rug Pull

Surging Hedging Stress

Time for the Elections Bump

Oil - Life After the Squeeze

40% later...Goldman upgrades China

Hedge Fund Positioning in Mag7 now lowest since May 2023

Yields Surge, Dollar Squeezes and Silver Set to Soar

Silver - Could Be Huge

3 Huge Moves We are Watching

S&P500 to 8000

China Market Squeeze Defies Gravity

Oil Shorts Burn Despite Dollar Dictating

7 Must-Watch Charts on Why You Should Sell Now

Downside Convexity, Sleepy Bids and Carry Chaos Comeback

Oil: Volatility Surge and Massive Shorts

Early August Flashbacks: Market Volatility Resurfaces

Volatility is Dead, Long Live Volatility

Important clues from the options markets

Gold: The Bull Case

Greed, Gains and Gamma Gridlock

China Stocks Surge Beyond Control

"Significant downside risks to oil in 2025"

100th percentile! We are back!

Don’t Be Fooled: VIX is Waking Up

Gold Needs a Pause

China Upside Panic - Extremely Overbought

Put Hate and Sudden China Love

Fun with flows: Expect more of the same

Thanks PBOC! We are exiting our China long

Double Top Danger and Disappearing Buybacks

Resistance, Fading Buybacks and Cheap Hedges

Rates to Revive?

Inverse "Exotic" Panic

China Crushing Shorts

Gold Stands Tall, Power Spikes and China Crushes Shorts

EM Boom: Fuelled by the Fed’s First Cut

3 Crashing Rates Volatility Charts

The Bullish Case for USD

Professionals Selling to the Amateurs

"It is almost hard to believe this"

Sexy September

Gone Till November

Beautiful broadening

Shining Gold While Stocks Ready to Chill

3 Gold Charts We Are Watching

How To Use Options At All Time Highs

Rising Odds of a Melt-Up

Magnificent 7: All Ye Need To Know

Bond Vol Dives, SPX Surges, and Laggards Eye Breakout

Going trading long China

100% of the time: Fed Cuts at ATH - Stocks Always Up 1 Year Later

Big Levels, Resistance and Dry Powder

China: Becoming The World's Problem

Gold - Fed Cuts, China Bid Fades and Heavy Longs

Short Term Rejection, But Long Term Bull

Do Not Worry About Earnings

Bitcoin Eyes Breakout

More Room To Run For Cyclicals

Year-end melt-up

Buying Biotech

Fed, Fading Buybacks and Fearful VIX

Playing Silver's AI Boom

Why So Serious? (part II)

Tech Positioning Has Declined Sharply

Why So Serious?

NASDAQ Hits Resistance as People Puke Puts

3 Charts of 3 Macro Assets

Gold Glitters and AI Sizzles

Here Come the AI Use Cases

Equities: Make or Break Approaching

Hated Oil: Primed for a Short Squeeze?

Crashing Crude: Collapsing Longs as Volatility Explodes

Gold: Debt Fears, Chinese Buying and Breakout Options

Haunted by The Carry Trade

Markets Battle Back After Worst Week Since SVB Collapse

NVDA: 100 is the "hold your nose and buy" level

Elevated Equity Fear

Has Tech finally lost leadership?

Update from 3 Prime Brokerage desks: Relentless selling

Fearful Friday

10 charts that keep us from getting too bearish

3 Charts On The Un-Inversion

Very Nervous Bond Markets

GS, BlackRock comes out in the defense of AI, Tech & Mag7

Sell Low, Buy High And Sell Low Again

The Yen Carry Trade Chaos - Act Two

This Actually Looks Pretty Scary

Jensen Sets A New Record

Panic Makes A Comeback

NVDA - is it finally happening ?

Seasonality And Straddles

September will be a very important month for the AI theme

Follow or Fade or Fight? $17bn of daily blind demand

Rates On The Rise

The Commodity Comeback: Secular Bull Just Getting Started?

Life After NVDA

Only 10 Days Left...

How to get to -50% in NVDA

Gold - Bull Run Losing Its Shine?

3 Rate Stress Charts We Are Watching

USD the most below 200-day in more than a year

The 12 things you need to know ahead of the NVDA print

Surging Oil, Soggy NASDAQ And Size Systematics

SPX Defying Volatile Currencies

Largest Tech Underweight Ever Going Into The Most Important Tech Print In Years

Who's Left To Buy?

Riding The Hot AI "Derivative" Trade

For Bears...And For Bulls

LLY back to ATH. Checking in on the obesity theme

Who Is Hot & Who Is Not In Magnificent Seven Right Now

Stress Charts We Are Watching

Time For A Dollar Comeback

SPX Streak Pushes Limits

Bitcoin As A Laggard Play

Desperate Buyers And Inverse Panic

Japanese Stress Reviving - Will It Spill Over Again?

A daily $10bn of unemotional buying

Are VCs now better at podcasting and bio-hacking than producing returns?

Greed, Fear, And Forced Buying

Gold's Power Play

Sell Low, Buy High Agony

A tactical long in China

"I tried it twice" - 10 less bullish observations on AI

3 Bounce Charts We Are Watching

Markets Post The Volatility Shock

Upside Force

No News Is Great News

She is actually leading

This matters more than AI or anything else over the next few weeks

Euphoria Erased, Bullish Buybacks and Jittery JPY

Time To Nibble Choppy Markets?

Is Everything Fine Post The Crash?

Hey ChatGPT, did AI save the world this week...?

What A Week!

Buying The Dip vs The Big Bear

Erratic Works Both Ways

AI Frenzy Fades - Is The Hype Over?

Fluid Markets - Volatility, Fear, And Fragility

Capitulation, Washed Out Trades And Erratic Markets

The Crash - Bottom Or The Beginning?

Watch Japan - The Epicenter Of Global Market Stress

Markets After The Bloodbath

Manic Monday

Broken Markets and VIX Extremes

Panic in Japan

The Weekend Crypto Crash

Dare The Tactical Buy?

Broken Markets In Full Panic Mode

Furious Friday Fear

Buy High, Sell Low Mania

Equity Fear Stays Strong

Time To Talk About Re-Grossing

Too Much AI Fear?

The Macro Mover At Huge Levels

Make Or Break As Panic Runs High

Watching The JPY Closely

NVDA Slips: Key Support Levels in Focus

Never Sell Your Bitcoin?

TME Weekend: Plummeting Revisions And Huge Index Deleveraging

Is The Risk Off Done Yet?

Shaky Market Confidence

Surging Tech Fear

Make Or Break

Stressed VIX

Bloodbath

Thresholds Are Getting Trashed

Anatomy of a very ordinary violent pullback

Higher hurdle: How good is good enough?

Lame ducks, sweeps & shading towards the mediocre

Trading Trump: One Day Before Concession

TME Weekend: Not Scared, Yet

Nervous Or Prudent? Hedge Funds Record De-Gross

Biggest AI Drop Since ChatGPT Was Released

Trading Trump: The Real Reason The Valley Boys Love Trump...?

Will AI Choose Violence?

That Was Quick: Back in the Range

"Buyers Are Out of Ammo"

10 MoMo Carnage Charts

5 Charts On That "Soft Landing"

Trading Trump

Small-Caps: For The Record Books

TME Weekend: ‘Quietly Defiant And Heroic’

5 Charts To Question If Now Is The Time To Be Bearish

Did Thursday Change Anything in the Tech Story...?

Mostly Peaceful Terrible Thursday

AI Or Crash: A "Show Me The Money" Attitude Starting To Emerge

Wednesday Worries: Starting To Age More Like Milk Than Wine

Bullish Longs And Some Overbought Extremes

Europe - Still A Mess

The AI Bubble, the Next Pain Trade and "Major Concerns"

Downside - The Next Pain Trade

The Slow-Mo Melt-Up: Hello 6000

BTC - "life below the 200-day moving"

TME Weekend: Bullet Proof

Have No Fear?

It’s the economy, stupid

The Crypto Crash

Random Pre July 4th Observations

Flows & Positioning supportive of the "just fine" bull market

Time For Seasonality Upside Force?

This Is The Trump Cocktail The Market Is Trading

Is This An Extreme In Extremes?

Time To Think About Rates

Nervous NVDA

Consolidation, Divergence, and Gamma Mania

The "Just Fine" Bull Market

Rejection And Cheap Hedging

Europe's Stress Is Back

Some Election Charts We Are Watching

Vanished Tech Shorts And Geared Hopes

Blasphemy in the AI church

3 Charts We Are Watching: Teflon European Stocks

Could Tesla Be Bottoming Out...?

Must Hold SOX Meets Dormant Panic

7 NVDA charts we are watching: $430bn gone

Slumping SOX And Nasty NVDA

The super bullish take on the AI decade ahead

Tech: Stretched, Crowded, Expensive

Bitcoin Blues

NVDA's First Negative Week: A Nothingburger...?

Tech Collision: Hedge Funds Selling and Retail Buying

Time To Care About BTC Weakness And Evaporated Shorts

An Unnerving Feeling of Something Not Being Entirely Healthy Beneath the Surface

The Reversal And The Big VIX Short

$10m for a mid-level AI product manager

Markets Overheat, Time to Hedge!

Soaring SOX - From Oversold to Overbought

KWEB - The Tech Laggard Play

The Bull In No Sell-Offs

Europe Stays Stressed

Overbought Mania

Overbought SPX: Meaningless or Misleading?

Europe - to hold or not to hold

How to get to 6300 in S&P500

France Lilliput

Teflon Tech vs European Chaos

Right-wing or Communism? European Panic - Part II

Top or Not?

European Panic - Will It Spread?

Busy Buybacks, FOMO and Inverse Panic

AAPL May Have Considerable Room to Run

Apple's Explosive Ascent And AI Pairs

Complacent Longs

Mean Reversion MA(I)nia

The Apple Event

Never seen this much "hedge fund hesitation" at an all-time-high

Rates Revival And Metals Meltdown

This is how the AI ecosystem gets cut in half

NVDA Peak Split Hype?

AI - Ain't A Bubble (Yet)

Has There Ever Been a More Powerful Theme?

Overbought and Unstoppable - The NVDA Effect

Rates - Too Hot or Cold for Equities?

King NVDA vs Soggy Small Cap

Something Is Really Changing

Suddenly these 2000 comparisons are back in vogue again

Shorts In Hibernation

Something's changing

TME Weekend: How Underweight Magnificent 7 Are You?

Teflon Tech Goes Turbulent

Market: Stuck and Stressed

NASDAQ Wobbles and Cash Dries Up

Not Everything Is High: Dow Puke vs Semis Groupthink

Rates Reviving

Tail Wagging The Dog in Tech?

The Hekaton Billionaire

Teflon Tech, Tired Trannies and Surging Rates

Capitalizing on Cheap Volatility

Black well vs Blackwell: Time for the mother of all contrarian trades

Here is what's next in the AI & Tech trade

The 10 most important observations from this week

The cyclical upgrade force is strong - but hedge funds sell aggressively

Market Beyond NVDA

Nvidia's AI Bull - Not Enough to Lift Market

3 Charts We Are Watching: Life After NVDA Earnings

Evaporated Shorts

Quiet Mania

NVDA And Beyond...

Bitcoin Frenzy: do we overshoot the range?

Bears Turning Bulls

3 Extreme Volatility Charts We are Watching: The Big VIX Short

Smells Like A Summer Rally

Shorts Gasp for Air: Tech Outflows, Utilities Surge, Semis Lose Steam, and Gold Breaks Out

Volatility's Dead? Think Again: Why Options are the Smart Play Now

Market on Pause: AI's Future, Volatility Resets and Sector Overheats

Bitcoin Breaks Trend Line but Faces Familiar Range

Breakout Chaos: Stocks Surge, Rates Retreat and Crypto Climbs

BCA says to long-term underweight US stocks and US tech stocks

Copper Overheated: AI-Driven Rally Getting Ahead of Itself

Bullish Bulls as Panic Evaporates

3 Bond Volatility Charts We are Watching

Enough of Bidenomics: US Exceptionalism Cooling

Systematic Swings, Big Buybacks and Well bid VIX

A 10 Year Extreme in Volatility

What's worse than being a non-AI stock?

The Vacuum Bull

Pain Trades and Choppy Markets

Metals and Miners on Fire

Short Interest Crashes, SPX Contradictions and the Inflation Savior

Gold's Pause

VIX Rollercoaster, Surging Utilities and Exhausted Sellers

FXI Peaks: Thank You, China - Time to Book Profits

Systematic Selling Meets Buyback Frenzy

The Fear Reset

Stuck in the Middle as Panic Implodes

Do NOT Pick A Fight With This Chart

Systematics The Least Long For The Year

Cheap & Growing: 10 Charts On Europe

Mind The Gaps

The Fear Fade and Crowd Chasing China

The massive gains from fat loss...

Utilities Better Than AI

Always a Bull to Chase

3 China Bull Charts We Are Watching

Massive Moves

Trannies Trouble Brewing?

Bitcoin Blues

The Reversal Could Trigger More Size Selling

2nd Half Earnings Recovery (Always)

Never Bet Against Elon Musk

Range Is All The Rage

SPX Resistance, NASDAQ Indecision and (A)Impact

3 Bitcoin Charts We Are Watching

Rising Dragon - The Squeeze in China

TME Weekend: Inflation Stuck, Dollar Flexes and China Bull

Positioning, Flows and Sentiment

Timing, Turbulence and Evaporated Hedges

3 Bounce Charts We Are Watching

King Commodities: Breaking Out Again

AI & Buybacks Saves The Day

The Long Gold Trade Still Has A Lot Of Positive Structural Things Going For It

Stubborn Streaks and Stubborn Rates

More Than $1 Trillion Of Blind Buying

Panic Resetting

Three Shades of Bears

The Bounce

The "Sudden" Destabilizer

Tech Titans: A bounce now and then the next move down?

On Everyone's Mind: Repeat Of August-October...?

Tech Turbulence: Semiconductor and AI Stocks Plunge

Battle Royal: Rare Hammer Candles Meet A Poor Risk-Off Backdrop

Down Is The New Up

Gold - The Ultimate Everything Hedge?

Cross-Asset Update: Checking In On Oil & Bonds

Triggers Were Crossed. The Ten Things To Know This Morning

High Fear, Low Panic

Bitcoin - To Hold or Not To Hold?

3 Charts: Which short-term seasonality matters?

Oversold, But Still Room To Hedge Wisely

Rates Edge Toward Danger Zone

Who is Right: VIX/MOVE or Credit Protection?

"Are you seeing panic?"

CTA Tsunami Unleashes Sell-Off Storm

Fear Is On The Move But Have We Already Gone Too Far...?

China: Contrarian Call To Stay Long

Bitcoin: More Rollercoaster than Refuge

TME Weekend: Some mega trends still look to be intact

Ugly Macro: Debtflation nation

Combo Of Elevated Positioning And Low Positioning Volatility Has Not Been A Great Set-Up

Market Panic Escalates

UBS Says Gold Could Double From Here

No So Bad Apple

You Don't Short Boring...Nor Range Lows

We are Getting Closer to a CTA Selling Tsunami

Houston, we might have potential MoMo problem

The AI pendulum is swinging

Market Fragility Into the Print

3 Gold Charts We are Watching: Time to Chill

3 Charts We are Watching: Under the Boring Surface

Between Panic and Placidity

Bitcoin Breaking Out: 3 Charts We are Watching

Rising Bond Yields: What Level Is Goldilocks, And At What Level Does It Start To Hurt?

Enjoy It While It Lasts - The "Best Of Times" In Flows Coming To An End

VIX Spike Points To 5% Setback

Ending the Week on a Stressed Note

So Many Bear Stories To Revisit

Sudden Stress: VIX Explodes as Market Tanks

Bitcoin - Fading Interest Inside the Range

3 Bond Volatility Charts We Are Watching

S&P's Test, Oil's Leap, Gold's Glare and Copper's AI Charge

4 Bond Charts We Are Watching

Shimmering Gold and Roaring Energy

Green Shoots of Fear

3 Energy Charts We Are Watching

Bitcoin at Must Hold Levels

Teflon Markets and Make or Break NVDA

Gold's Wild Surge: Mastering the Long

TME Weekend

Energy Ascends the Throne

Russell - Chasing Laggards

The Great Volatility Outlier Is Crashing

From AI Hype To 5900 High

The Largest Rebalance Going Back To June 2023

New King vs Old King - NVDA vs Apple

Fed Who? SPX Rides The Growth Wave

Stretched positioning meets sober valuation

Frenzy of Flows and Fades

The Bitcoin Bounce

Europe's best streak in 12 years

The greatest trick Miss Market ever played...

The reasons for the low volatility and how to play it

TME Weekend: 4 Themes We Are Watching

Vanishing Volatility and Big Buyers

3 Bitcoin Charts We Are Watching

3 China charts we are watching

Soaring Semis, Sad Apple and Stinky Skew

The Looming Threat of Upside Pain as Bond Volatility Nosedives

Semis Surge, Volatility Crumbles, and Bulls Charge

Bitcoin At Support Levels

Low cost of optionality going into FOMC

NVDA: Humans Got Five Years & Here Comes The Saudis

Risk Rush: Equities Blaze as Cash Crumbles and Oil Ignites

SOX - From Exuberance to Prudence

How Bad Is This Hangover in Bitcoin?

Rally or Ruse?

Rally or Retreat? The 4.35% Yield Dilemma

12 Tech Observations

Tesla: Is this the cut we buy into?

Finally

Flat Is The New Bull

Will Bears Resurrect This Easter?

Here Are The Six Key Challenges NVDA Is Facing

Beyond the Bell: Bitcoin's Post-ETF Launch Off-Hours Rally

Not so sexy SOX meets NVDA's volatile stagnation

Rates are moving - and all stocks except for 7 should pay attention

Bond volatility moving sharply lower

MEME's maverick moves, SOX's swings, and tech's teflon triumph

Options mania takes center stage

Bitcoin's bromance

Navigating the upside force

Momentum mania...but it works both ways

NASDAQ key levels tested amidst stretched sentiment and positioning

Too much dominance

3 "fear" charts we are watching: VIX the outlier

Charting chaos: NVDA's leveraged dive and some more

Bubble or bargain: Perceived vs realized bull

Complacency - who is left to buy?

NVDA Frenzy: Buy or Beware?

Back to the future : That 1995 right tail

VIX skepticism, gold's hot streak and idiosyncratic risk

Tech and momentum - as good as it gets?

Green shoots of fear

Bull getting tired - a few warning signs not to dismiss

In the long run, valuation matters more than anything

Glitter & Gigabytes

Gold's crucial test

When insane strength and supportive seasonals meet full positioning

Crazy contrarian? The sell case in Tech

Why mess up a good thing?

Miss Inflation moves in mysterious ways

Teflon tech's tidal wave

AI, big tech and SPX 5500

Bitcoin - this has never happened before

Speculmania - from Bitcoin frenzy to odd lot mania

Déjà vu. Very similar set-up to last summer's perfect sell signal

Upside force vs cognitive dissonance

1 or 0. Tech vs the rest

The pulse of the big bounce

Party like it is 1995?

Is Google the next "Go Woke Go Broke" trade?

Skew meltdown: Complacency offers cheap hedges

Perceived vs actual bull

The last of us

Not even 1999 yet

Post upside crash pulse

3 charts: The big implosion in volatility

Bulls take yet another victory lap

More important than NVDA now

"NVDA could become a 10 trillion dollar company"

The 12 things you need to know ahead of the NVDA print

3 charts we are watching: The furious China bounce

Tech tremors: All eyes on NVDA

If only there were signs: Call options frenzy

The trouble with Tesla and 10 other weekend charts

If only there were signs...(part 2)

Tech titans and bubble troubles

If only there were signs...

Semis surge sparks sell signal

Now or never

Bubble Maths: S&P500 6250

Downside protection: Cheap thrills in market extremes

Hey ChatGPT, give me 3 reasons why NVDA will trade down

4 charts we are watching: Will recent rates action spill over to stocks?

Say hello to panic

Market at critical levels as investors hunt downside protection

3 charts we are watching: VIX, gamma and CTAs

NVDA's spectacular squeeze and upside down market risks

High stakes, high tech

As stretched as its been in the post-Covid era

Closing in on sell signals

A macro guru sat down with a tech specialist

Market mania and complacency

Sleepy SPX, soaring MEMEs, and skewed "signals"

We have heard that stocks actually can trade down as well...

Earnings illusions and Euphoric optimism

Tech breaking up despite one thing less magnificent

Ditching defense for tech dominance

NVDA: The most extreme we have ever seen

Teflon tech defies rates

3 charts we are watching: Rising rates

More beats & bigger rewards: The 7 things you need to know from earnings

TME Weekend: There’s room to add more to exposure

If you see a bubble, ride it

Upside panic

That upside force

3 charts we are watching: Mechanical selling

Euphoria meets reality

Overshoots, front-running and decoupling

Tech and AI vs long longs and downside convexity

Are we skipping FOMO and going straight to Inverse Panic?

China's bear: A local issue or a global warning bell?

It's good...but it won't always be this good

3 charts: Bond volatility moving lower, and it's helpful for the bull

This is how macro guru Dominic Wilson trades this market

TME Weekend: Teflon bull

China hope springs eternal: Green shoots somewhat visible

Why so serious?

Tech surge, February fears and big China

3 divergences we are watching

Chasing tech, oil, China and cheap puts

This is bound to happen as the next phase of the bull market

Tesla disqualified from Magnificent 7...?

Overbought NASDAQ, VIX's resilient floor, and China's price extremes

Inverse fear and upside pain

"If you aren’t long, you’re short"

3 charts: The pockets of the market that are stretched

10 charts on the China crash

Crude awakening and China turbulence

Are we all actually under-invested in tech...?

The "far from Euphoria" ATH

TME Weekend: Beat rates 2nd worst in 7 years

10 things to know about this ATH

Feeling FOMO

Tech titans triumph

Crude dynamics, crypto conundrums and static SPX

Rates refusing, tech trying, while VIX and crap stay nervous

Surging rates and stuck equities

Market tension rises: VIX in fear

Somebody is in urgent need of hedges

Signs of fatigue: July top déjà vu

All-time-low short base

India is the new China

The Magnificent 7 in a consolidation phase. What's next?

GS bankers see a strong pick up in M&A interest YTD

TME Weekend: 2024 will see a merger & buyback bonanza

Healthcare hopes. Many reasons to believe that 2024 will be a great year for the sector

Europe at a record discount

Positioning is extremely long

Gates gangster. Ballmer baller

Low bar, low on deals & crap continues crashing

There are new vibes in China

That upside force...

And it is gone! Gamma edition

3 charts we are watching: Bond volatility "healing"?

Teflon NASDAQ: Decoupling and divergences

3 oil charts we are watching

"Healthy longs" stuck in the range

Front running the "low bar"

Short term positioning post the sell off: Less stretched

China: Boom to bust - is there hope for a comeback?

Positioning and technical indicators flash warning signs

Market tension rises: Buybacks wane, CTAs sell and Apple wobbles

Resurfacing of forgotten risks

Far from panic

Apple: The "sentimentor" approaching must hold levels

Hard to get excited: Be boring

Big (small) cap pain

3 charts we are watching: Bond volatility on the MOVE

The big long

A few charts we are watching: Rates, VIX and skew

Dangerously bullish: No caution signs

RIP Dash-for-Cash

Can Sentiment & Positioning get even a little more extended?

Best housing crash ever

Naughty or nice?

The bull/bear signal, liquidity, GenAI and Santa hedging

Tech troubles and VIX fear lurks

Shaken, not stirred. 9 things you need to know on the sell-off

Acrophobia alert: market has risen too far too fast

Cheap options and gamma shakeup

One more bullish observation and our brains will implode

Powell's power, put hate and overbought mania

Hello FOMO my old friend

Fearless FAANGS and small cap extremes

3 oil charts we are watching: another laggard

Looking for laggards: China

Looking for laggards: Healthcare

The 10 latest charts you need to know on sentiment & positioning

Is the FOMO switch out of cash finally happening...?

Small cap extremes, de-grossing risk, and contrarian caution

Max pain market

3 option charts we are watching: "Renting" is cheap

Power of the Powell "pivot"

3 vol charts we are watching

All I need for Christmas is more Tech

Market fear evaporates

Liquidity boost, Santa effect, and overbought "satellites"

3 European charts we are watching: Hedging the melt up

Finally, sentiment & positioning levels associated with a top

Big buy fading

JPY dilemma: carry or carried out

JPY buying frenzy and Russell call craze

Furious JPY: Is it the spark VIX needs for action?

Exuberant breadth and magnificent selling

Time to talk about bond volatility again

TLT's tumultuous trend and tech troubles

The perfect flow Tsunami is over and it is time to put on tactical shorts

Big short gone big long

3 charts we are watching: Extremely cheap hedges

3 gold charts we are watching: Looking topish

3 charts we are watching: Changing of the guard

TME Weekend: Some still have plenty of room to add

The ultimate guide to "why we are NOT yet there"

Put seller king reigns as greed grows

SPX stuck in a snooze

Volatility - beneath the calm surface

Laggards leading

Bond bonanza and imploded equity volatility

Rally on the razor's edge: Rejection, risk, and rally doubts

Energy and oil - dark horse of Q1?

Market's risky calm

The brutal gold break up

Pay attention! The bull could be running out of steam

Well supported for now

A lot of extremes in November

TME Weekend: 10 things that you might have missed

Tech love and equity inflows upend VIX

3 charts we are watching: Stretchy sentiment

Vanishing volatility

Magnificent tech t(A)itans

3 charts we are watching: Options extreme

The bullish backdrop is still too strong to short

The long is long

3 charts we are watching: CTA buying done

Tech's 2-year anniversary

Tech on fire

Hitting "natural floor" volatility as inverse fear kicks in

Are we there yet? 3 for and 6 against

Bond convexity, equity inflows and cheap options

3 charts we are watching: Largest buying on record

Oil markets in turmoil

We have come along way

3 charts we are watching: Teflon tech

Everything you need to know about the incredible Magnificent 7

Life after the traumatic squeeze

So now it begins....No, now it ends

Upside panic - shorts carried out on stretchers

Some charts on bond beauty: All ye need to know

3 charts we are watching: Big busy buyers

Bullish bears

3 charts we are watching: Big systematics squeeze upcoming?

Rare to see GS this bullish. Should we pay attention?

How unhealthy? Pharma at 5-year lows

3 charts we are watching: These gaps refrain us from becoming too bullish

TME Weekend: One group to rule them all

Pharma at 5 year lows

Shorts running scared

3 charts we are watching: Some early indications of weakness

Trading trend reversals

Too many bulls

Ready for the "Everything Up Market" in 2024?

VIX - post the epic reset

P/L pain, CTA chasing and imploding war hedges

Does it look like a top or not?

Markets stabilize post-craze: What comes next?

3 charts we are watching: Life post the brutal squeeze

Gold's fragile highs

TME Weekend: Duration has no friends until the data dumps

Real or fake Santa? The 7 things you need to know about the golden week of gains

What a week

4 charts we are watching: TLT panic

Just a squeeze or a real new bull...?

Keep calm and risk on

3 charts we are watching: The canary is alive

$11bn of daily buying....What could go right in November?

Powell's pivot: Where stocks climb and rates dive

VIX - down but not out

3 charts we are watching: What could go right in November?

TME Daily: In what macro backdrop will stocks work?

TME Daily: A tale of two cities for both earnings and positioning

On correction & crashes

TME Weekend: Will Powell prevent a “scarytale” ending?

Is this the bottom?

Market dips "frighteningly" low

The current pulse of the bear

Nearing the edge of overblown fear?

The one that matters. As AAPL goes, goes the market.

Tech trauma: Half a trillion gone yesterday. $4 trillion since the summer peak

Technical Trouble

Stress remains high, but will the buyback bid and seasonality calm things down?

To hold or not to hold

5 Bitcoin charts we are watching

Contrarian catalysts

The Ackman top. Rates reversing?

The 3 things you need to know about the surging VIX

China - from bad to worse

TME Weekend: QT in vogue, reversed iceberg and the fattest trade

The 10 things you need to know about the selling this week

From VIX exuberance to prudent fear

Fear is here. Will there be panic?

Green shoots of panic

3 charts we are watching: Our canary is not feeling so good

The Generals at 46x. Is it sustainable?

China in turmoil

Something's gotta give: Haunted by bonds

Bonds' parabolic panic

Market anxiety persists

3 charts we are watching: Goldman says not out of the woods

"Lower for longer" pain

Oil to $150? Or not at all?

3 charts we are watching: Bond extremes

Stuck in neutral: What's next?

3 charts we are watching: Volatility on the run

China: Is there ever any light in this tunnel?

TME Weekend: House-to-house

The Kate Moss trade

Nervous

Someone buying size in war hedges

Rate rage revenge

VIX - defying long term logic

Climbing the wall of "upside pain"

3 squeeze charts we are watching: Thanks for playing

3 charts we are watching: Rates rollercoaster

Sell low, buy high strikes again

Bond bottom

Seasonality starts now

A lot of selling, but still not at extremes

TME Weekend: The squeeze vs the Fed

3 charts we are watching: Buy or Buy

Sell low, buy high goes extreme

Brace for the bounce?

Bondmageddon looms

The Oil roundtrip: That was quick

3 charts: Some stress refuses to ease

Max pain market

3 charts we are watching: Early green shoots of stabilization

3 charts we are watching: Rates reversing?

3 charts we are watching: 1987

Risk ripples

3 charts we are watching: VIX on the run

Typically ends in an accident

Dollar and rates surge, oil dips, while volatilities stay bid

3 charts we are watching: This could cause severe P/L pain

Is the QT trade back on?

Magnificent 7: Time for the next leg higher

3 big charts we are watching

TME Weekend: Some things are as neutral as they get

Currency crossroads & metals meltdown

3 charts we are watching: Bounce bullets

Crying Wolf on the US Consumer again. But is it for real this time?

Bear barrage

It will end in disaster

3 charts we are watching: Bounce belief still un-broken

Systematic storm: aggressive gamma and volatility punters

Rude crude

3 charts we are watching: Buying VIX here is a late trade

All that Dry Powder. M&A set to make a comeback

From VIX euphoria to palpable panic

3 charts we are watching: If it does not bounce soon it can get nasty

Oil - now what?

3 charts we are watching: -50%

It should really bounce around here...

3 charts we are watching: Huge levels! Make or break

Europe dancing on the edge

From "sad September" to "optimistic October"

TME Daily: Hedgies retreat, tech tanks and energy's blaze

TME Daily: Hedgies retreat, tech tanks and energy's blaze

Rates Rock and Roll: America no better than Greece

3 charts we are watching: Systematic Tsunami

Market's wake-up call

3 charts we are watching: Make or break

VIX awakens

Volatility - the dormant beast

3 charts we are watching: Oil reversing

We need to talk about inflation...

TME daily: Prime time for affordable hedging

3 charts we are watching: What is the next delta in housing?

10 things you need to know about the oil rally

High conviction neutral

3 charts we are watching: tired generals

TME weekend: Tech unraveling, cheap hedges and oil chasing

The 12 things you need to know on investor positioning

Is today the start of VIX perfection?

3 charts we are watching: what are we actually trading?

Fear in freefall

Incremental reasons to try a contrarian long in China

3 charts we are watching: bond volatility at 7 months low

AI aristocracy, Russell roulette and luxury's double-edged sword

A few more weeks of weaker seasonality and then a year-end melt-up?

Oil mania

3 charts we are watching: Remember, VIX seasonality starts now

Oops on inflation

TME daily: chasing fa(i)t

"It is so wrong that it might actually be right"

MoJo in the DoJo: Musk has the world in an Anakonda Chokehold

3 charts we are watching: Squeeze potential; really?

TME Weekend: You come at the king, you best not miss

Fat is the new gold

Stuck in no man's land

Fade or fad

Enjoy it while it lasts, 'cause it never does

Frustration running high

Sudden fear: As Apple goes…

Butterfly effects? Risk is global

Riding the rate rollercoaster

Europe: You would not believe it

That massive disconnect from rates. Why is it so?

"You buy protection when you can, not when you must"

Yield puzzles, oil sizzles and 4800 dreamzzz

Are we ready to party like it is 1999?

Bond MOVEs and tech trust

Landing me softly: Earnings now a backstop for equities

TME Weekend: I have abandoned my fear

Black gold booms

3 oil charts we are watching

Puts tumbling, oil teasing and QT thundering

Calm waters all of September?

From bears to bulls to AI booms

Trend trauma - massive systematic flow

Time for gold

From oversold to overdrive

Inverse panic mania in volatility

3 charts we are watching: contrarian in bonds

Fearless VIX is back

Crowded tech crowd

3 charts we are watching: crashing fear

TME Weekend: All caught up

Do we add this one to the textbooks?

Nasty NASDAQ

4 charts we are watching in volatility land

NVDA: "the time to worry is not now...."

NASDAQ loving it

Rates vs equities at an extreme

It will end in disaster

Can tech dismiss rising rates?

3 random charts we are watching

Extreme sentiment swings

Only 5% down and some things flashing oversold already…

Crying China

TME Weekend: Tail risks

Meadow Lane mellow

Meadow Lane mellow

It's like déjà vu all over again

5 charts we are watching: Cash is not Trash

Nobody knows nothing

"this is no longer a buy-the-dip market"

Never bet against the American family formation

Fast money & systematic sellers hit the structural bid

She moves in mysterious ways

Are we wrong not to be max long?

Re-grossing again. Positioning at the 99th percentile

TME Weekend: Extremely many "extremes"

Some stuff is hot (again) and some is not

Intraday volatility surge intensifies market risks

No longer muted

The rally is over

Tactical headwinds

Market teasing with big levels

Green shoots of fear

CTA & vol control funds reflect extreme downside convexity

Market in agony and pain

Apple matters

Rates matter

TME Weekend: "Not a rosy picture"

Cracks in the market

Stressed on a Friday

Rates mania...and potential equity selling

No panic here (yet)

Volatility spikes as fear returns

Beyond the downgrade...

Dollar, rates and the MOVE(s)

Say hello to August

Alpha agony and the "inevitable" pullback

The long is longer

SPX bull, euro pitfalls, and China's wildcard

The bull run's new normal

Muted earnings cheers, inflation puzzles and a China squeeze

Optimism or complacency - hedge it

Hated hot banks

Crowded trades, retail frenzy and the pain trade

Fearless FOMC

The long is very long

Crude awakening

Chip slip and the tech tumble

The China shit-show no one saw coming

Here we go housing

Tech cools, retail rages and some madness

Even "revolutions" need to take a break

Evaporated bears

Inverted fear

There is always a squeeze somewhere

Here we go housing

Volatility and the "natural" floor

Cash flood, beta surge and the recession ghost

Sentiment and positioning: stretched is the new normal

"Implied Bid" defies overbought markets

Terrific teflon tech, but...

Sell low, buy high agony continues

Thrills, spills, and potential market chills

Defying gravity

Fear smoked

Chase it until it breaks

Positioning, Convexity and P/L pain

Wobbly big tech

Rougher times ahead?

The fA(I)de

Could rising bond volatility stir the SPX?

Shaken, not stirred (yet)

Three "fear" charts we are watching

Teflon tech defies rates

Notable divergences

It's like déjà vu all over again

Positioning: "Is the glass half full or half empty?"

Battle of the Bulge: Macro bears try to strike back

TME Weekend: 9 things you might have missed

Front-running July

A lot of "likes"

You cannot keep a good bull down

Tourette type of market

Beware the aggressive seller

TME Weekend: Will Wagner wake VIX?

Welcome to upside down

Down - mission impossible

From housing horror to housing hopes

The reversal?

If we do not have a pullback now we never will

Too much too fast

Time to move more freely

It is getting extremely extreme

TME Weekend: Some might say...

Beyond the triple witch

The options boom

When the 1999 mania looks poor

Teflon AI

Life after FOMC

Laggards, crap & underdogs were not there yet

Better than 1999

Are we there yet? Holy crap!

Pre FOMC FOMO

Are we there yet? The volatility angle

Are we there yet?

(Ir)rational exuberance

TME Saturday: Disco 2000

New bull, soaring greed and affordable hedges

Too fearless: time for some VIX calls

10 reasons why we are shorting the market here

Happy days

Finally: exuberant bulls and receding bears

VIX and it's immunity

Tech - life after the melt up

Just a pause...or will it lead to frustration?

Revival of the underdogs

Are we there yet?

Overbought tech needs a pause

Right tail still wagging dog investors

Tech surge leaves fear behind

Melt-up ménage à trois

Violently fearless

It is beginning to look a lot like FOMO

Look up

Where are we in this bubble?

Fall without the fear

Last time this happened...

China's reopening from hell

Beyond parabolic: NYFANG mimics August 2020 tech fever

Mighty Tech: Overbought but can get more overbought

Stubborn Euro longs face a resilient dollar comeback

Beyond the deal

Tech on steroids: AI the savior, or?

A narrow tech decoupling

Some 00/01 reminiscence

All about NVDA...and some more

3 charts we are watching: Finally FOMO?

"Fat and flat" mania

Cracks beneath the surface

Three charts we are watching

Cracks in the Great Wall

Time to talk about the NASDAQ long

Signs of exuberance: we had a few but....

TME Weekend: Lowest in 20 years

Narrow rally as liquidity peaks

Melt-up momentum

Tech titans skyrocket: dancing on the edge of overheating

Frustration mania as we climb the wall of worry

Finally some moves

Underdog rising: could small caps revive?

From tech highs to debt ceiling and tail risks

Gold breaks supports and CTAs need to sell size

Boredom and bears

Can we please move?

Flat & Flat

TME Sunday: Much ado about nothing

TME Sunday: Much ado about nothing

TME Saturday: Either or

Better than 1999

Liquidity, downside convexity and hot short volatility sellers

One stock: 3rd largest stock market in the world

The "what if" bull

Bullish charts, bearish crowd

Dollar - the comeback kid

Range-bound mania

Big Tech & MOVEs

Warnings signs, but what if...

How to play the "No good option"

The new panic: fear of calm markets

Still stuck in the mud

Size selling in time for the buyback bonanza

Here is why we are so flat

Sell low, buy high market is alive

Gold regains status as fear hedge, but...

Market faces systematic selling and renewed liquidity tightening

Oil rollercoaster: navigating volatility and range trading opportunities

Pow(OI)elld

KRE: The latest thoughts from the sell-side

MOVEs are back

Anatomy of a 1-day sell-off

Is NASDAQ immune?

Goldilocks market?

VIX seasonality: will debt limit impact volatility?

This new bull market has a name (and a mega-theme)

Can narrow market breadth sustain equities rally

April's fab five

Three charts we are watching

Welcome to (tech) upside panic

Unstoppable tech?

Puts comeback, mega-cap crowding concerns...but buybacks are kicking in soon

If it goes down a little it can go down a lot

Finally some moves

Big troubles in little China?

Taking a ride on the flat-line

Flat & Flat

The debt ceiling debacle: Could it derail the 2023 bull?

TME Weekend: Boring for longer

Boredom persists, but downside convexity is back

Post-expiry: going to move more freely

Three reasons for why there could be some further downside

Sell low, buy high crowd is long

Trapped - volatility, liquidity, and seasonality to shape the next move

Massively unchanged (again)

Debt ceiling jitters rattle markets and liquidity

Squeeze Pause - Back to "Flat & Fat"

Sell in May?

Slow-mo frustration

Say hello to inverse panic - VIX guy is back

Charts we are watching: the mighty euro

All quiet on the market (or squeeze) front

TME Weekend: Squeeze 5.0

Three "risky" charts to watch

The Bitcoin bid

Have no fear?

Potential squeeze 4.0: Extreme positioning in banks

"Too damn short". Squeeze 3.0

Inverse panic kicking in

Too damn short 2.0

Upside FOMO - next pain trade?

Use low volatility for directional trades

Waiting for the next direction

Reflections on Tech technicals

Still too many "damn shorts"?